SEBI Officer Grade A Syllabus 2020: Officer Grade A (Assistant Manager) Posts – 147 Vacancies – SEBI Officer Grade A Phase I Exam Date: 17.01.2021 & Phase II: 27.02.2021 – Download SEBI Officer Grade A Syllabus 2020 @sebi.gov.in

SEBI Officer Grade A Syllabus 2020: Securities and Exchange Board of India has recently released their SEBI Grade A Syllabus for SEBI Grade A Officer Phase I Online Examination for the posts of Grade A (Asst. Manager) with 147 vacancies. Aspirants who are going to prepared for SEBI Grade A Phase I CBT Exam they may download SEBI Officer Grade Phase I Online Examination Syllabus here. Syllabus, Exam Pattern, Exam Scheme and Exam Dates are available now at SEBI official website @sebi.gov.in. SEBI Officer Grade A Phase I Online CBT Exam will be held on 17th January 2021 & Phase II Online Exam will be held on 27.02.2021.

| Notification Details | |||||

|---|---|---|---|---|---|

| Recruiter | Securities and Exchange Board of India (SEBI) | ||||

| Designation | Officer Grade A (Assistant Manager) | ||||

| Exam Name | SEBI Grade A Phase 1 & Phase II Online Exam | ||||

| Job Location | Across India | ||||

| Vacancies/Post | 147 | ||||

| Official Website | sebi.gov.in/ | ||||

| Join our Telegram | |||||

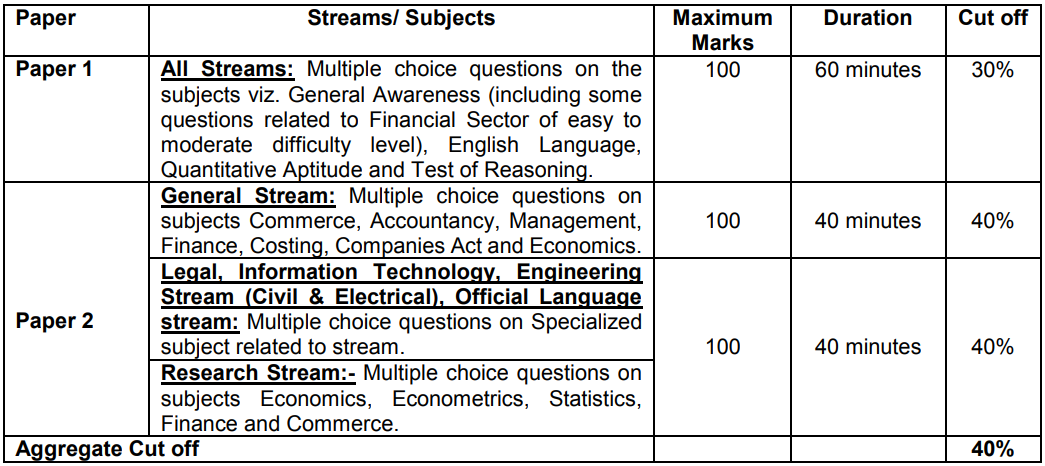

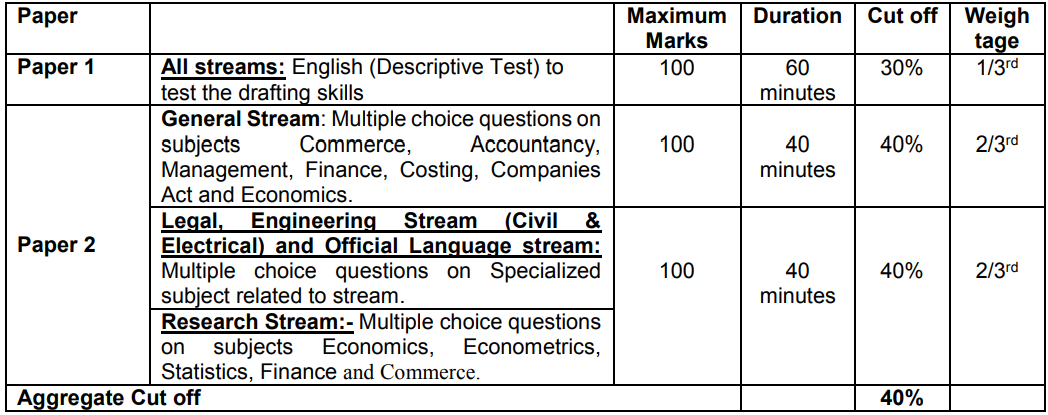

According to the SEBI recruitment 2020 notification, the selected contenders will be placed anywhere in India as decided by the concerned Organization. The selection will be based on Phase-I (Online Screening Examination), Phase-II (Online Examination) and Phase-III (Interview). SEBI Phase I & Phase II examination contains two papers (Multiple Choice questions of 100 marks each) and subjects/ streams wise syllabus, exam patterns are given below. Our Employment site will helps candidate to find out how much time should be invested in preparing for the particular topics. To crack the exam, it is better to keep the syllabus in mind while preparing for the exam. We will provide you detailed information on SEBI Officer Grade A syllabus for Phase I and II in this article. Our site provides SEBI Officer Grade A Admit Card 2020,various set of syllabus for various organization/ recruitment, here you can get SEBI Officer Grade A syllabus PDF, Cut off, Exam pattern/ Scheme, etc.

SEBI Officer Grade A Exam Pattern/ Scheme 2020

SEBI Officer Grade A Syllabus 2020

SEBI Grade A Syllabus For Phase I: Paper I

SEBI Grade A Syllabus Phase I For Paper I will be common for all the candidates. This will have MCQ’s of 100 marks. Paper I will have four sections:

- English Language

- Reasoning Ability

- Quantitative Aptitude

- General Awareness (including Financial Awareness)

English Language: Error Spotting, Reading Comprehensions, Para Jumbles, Para Completion, Vocabulary, Error Spotting, Passages, Sentence Improvement, Cloze test.

Reasoning Ability: Coding & Decoding, Puzzles, Seating Arrangements, Direction Sense, Blood Relations, Syllogisms, Inequalities, Order and Ranking, Coding-Decoding, Machine Input-Output, Alpha-Numeric-Symbol series, Data Sufficiency, Number System and Conversions, Logical Reasoning etc.,

Quantitative Aptitude: Data Interpretation, Inequalities, Number Series, Approximation and Simplification, Data Sufficiency, HCF and LCM, Inequality (Quadratic & Quantity based), Profit and Loss, Time and work & Pipe and cistern, Permutation, Combination & Probability, Problem on Ages, Work and Time, Speed Distance and Time, Mensuration, Average, Ratio and Proportion etc.

General Awareness:, Current Affairs, Financial Awareness, Current Affairs – National & International, Budget, Awards and Honors, Important Financial & Economic News, Important Days, International & National Organizations, Sports, Books and Authors, Science – Inventions & Discoveries, Countries & Capitals etc.

Syllabus for Paper 2 of Phase I

Commerce & Accountancy

- Accounting as a financial information system.

- Accounting Standards with specific reference to Accounting for Depreciation, Inventories, Revenue Recognition, Fixed Assets, Foreign Exchange Transactions, Investments.

- Cash Flow Statement, Fund flow statement, Financial statement analysis; Ratio analysis.

- Accounting for Share Capital Transactions including Bonus Shares, Right Shares.

- Employees Stock Option and Buy-Back of Securities.

- Preparation and Presentation of Company Final Accounts.

Management

- Management: its nature and scope; The Management Processes; Planning, Organization, Staffing, Directing and Controlling.

- The Role of a Manager in an Organization. Leadership: The Tasks of a Leader.

- Leadership Styles; Leadership Theories; A successful Leader versus an effective Leader.

- Human Resource Development: Concept of HRD; Goals of HRD.

- Motivation, Morale and Incentives: Theories of Motivation; How Managers Motivate; Concept of Morale; Factors determining morale; Role of Incentives in Building up Morale.

- Communication: Steps in the Communication Process; Communication Channels; Oral versus Written Communication; Verbal versus non-verbal Communication; upward, downward and lateral communication; Barriers to Communication, Role of Information Technology.

Finance

- Financial System- Role and Functions of Regulatory bodies in the Financial Sector.

- Financial Markets- Primary and Secondary Markets (Forex, Money, Bond, Equity, etc.), functions, instruments, recent developments.

- General Topics

- Basics of Derivatives: Forward, Futures, and Swap

- Recent Developments in the Financial Sector

- Financial Inclusion- use of technology

- Alternate source of finance, private and social cost-benefit, Public-Private Partnership

- Direct and Indirect taxes; Non-tax sources of Revenue, GST, Finance Commission, Fiscal Policy, Fiscal Responsibility and Budget Management Act (FRBM),

- Inflation: Definition, trends, estimates, consequences, and remedies (control): WPI, CPI – components, and trends.

Costing

- Overview of Cost and Management Accounting – Introduction to Cost and Management Accounting, Objectives, and Scope of Cost and Management Accounting.

- Methods of Costing – Single Output/ Unit Costing, Job Costing, Batch Costing, Contract Costing, Process/ Operation Costing, Costing of Service Sectors.

- Basics of Cost Control and Analysis – (i) Standard Costing, (ii) Marginal Costing, (iii) Budget and Budgetary Control.

- Lean System and Innovation:-

- Introduction to Lean System

- Just-in-Time (JIT)

- Kaizen Costing

- 5 Ss

- Total Productive Maintenance (TPM)

- Cellular Manufacturing/ One-Piece Flow Production Systems

- Six Sigma (SS)

- Introduction to Process Innovation and Business Process Re-engineering (BPR)

Companies Act

- The Companies Act, 2013 – Specific reference to Chapter III, Chapter IV, Chapter VIII, Chapter X, Chapter XI, Chapter XII, and Chapter XXVII.

Economics

- Demand and Supply, Market Structures, National Income: Concepts and Measurement, Classical & Keynesian Approach Determination of output and employment, Consumption Function, Investment Function, Multiplier and Accelerator, Demand and Supply for Money, IS-LM, Inflation and Phillips Curve, Business Cycles

- Balance of Payments, Foreign Exchange Markets, Inflation, Monetary and Fiscal Policy, Non-banking Financial Institutions.

Syllabus for Paper 1 of Phase II

- Precise Writing

- Essay Writing

- Letter Writing

Syllabus for Paper 2 Phase II General Stream (Common Syllabus for both phases)

Commerce & Accountancy

- Accounting as a financial information system;

- Accounting Standards with specific reference to Accounting for Depreciation, Inventories, Revenue Recognition, Fixed Assets, Foreign Exchange Transactions, Investments.

- Cash Flow Statement, Fund flow statement, Financial statement analysis; Ratio analysis;

- Accounting for Share Capital Transactions including Bonus Shares, Right Shares.

- Employees Stock Option and Buy-Back of Securities.

- Preparation and Presentation of Company Final Accounts.

Management

- Management: its nature and scope; The Management Processes; Planning, Organization, Staffing, Directing and Controlling;

- The Role of a Manager in an Organization. Leadership: The Tasks of a Leader;

- Leadership Styles; Leadership Theories; A successful Leader versus an effective Leader.

- Human Resource Development: Concept of HRD; Goals of HRD;

- Motivation, Morale and Incentives: Theories of Motivation; How Managers Motivate; Concept of Morale; Factors determining morale; Role of Incentives in Building up Morale.

- Communication: Steps in the Communication Process; Communication Channels; Oral versus Written Communication; Verbal versus non-verbal Communication; upward, downward and lateral communication; Barriers to Communication, Role of Information Technology.

Finance

- Financial System

- Role and Functions of Regulatory bodies in the Financial Sector.

- Financial Markets

- Primary and Secondary Markets (Forex, Money, Bond, Equity, etc.), functions, instruments, recent developments.

- General Topics

- Basics of Derivatives: Forward, Futures, and Swap

- Recent Developments in the Financial Sector

- Financial Inclusion- use of technology

- Alternate source of finance, private and social cost-benefit, Public-Private Partnership

- Direct and Indirect taxes; Non-tax sources of Revenue, GST, Finance Commission, Fiscal Policy, Fiscal Responsibility and Budget Management Act (FRBM),

- Inflation: Definition, trends, estimates, consequences, and remedies (control): WPI, CPI – components, and trends.

Costing

- Overview of Cost and Management Accounting – Introduction to Cost and Management Accounting, Objectives, and Scope of Cost and Management Accounting.

- Methods of Costing – Single Output/ Unit Costing, Job Costing, Batch Costing, Contract Costing, Process/ Operation Costing, Costing of Service Sectors.

- Basics of Cost Control and Analysis – (i) Standard Costing, (ii) Marginal Costing, (iii) Budget and Budgetary Control.

- Lean System and Innovation:-

- Introduction to Lean System

- Just-in-Time (JIT) Page 20 of 26

- Kaizen Costing

- 5 Ss

- Total Productive Maintenance (TPM)

- Cellular Manufacturing/ One-Piece Flow Production Systems

- Six Sigma (SS)

- Introduction to Process Innovation and Business Process Re-engineering (BPR)

Companies Act

- The Companies Act, 2013 – Specific reference to Chapter III, Chapter IV, Chapter VIII, Chapter X, Chapter XI, Chapter XII, and Chapter XXVII.

Economics

- Demand and Supply, Market Structures, National Income: Concepts and Measurement, Classical & Keynesian Approach Determination of output and employment, Consumption Function, Investment Function, Multiplier and Accelerator, Demand and Supply for Money, IS-LM, Inflation and Phillips Curve, Business Cycles

- Balance of Payments, Foreign Exchange Markets, Inflation, Monetary and Fiscal Policy, Non-banking Financial Institutions.

Download SEBI Officer Grade A Syllabus 2020

- Visit official website of SEBI @sebi.gov.in.

- Now, find & click the Syllabus for SEBI Officer Grade A.

- Open the Syllabus and download it.

| Important Details |

|---|